Sara owns an automobile for personal use. The adjusted basis is $13,500 and the FMV is $10,500. Sara has owned the car for two years.a. Calculate the realized gain (loss) if Sara sells the vehicle for $12,500. b. Calculate the recognized gain (loss) if Sara sells the vehicle for $12,500. c. Calculate the realized gain (loss) if Sara sells the vehicle for $15,000. d. Calculate the recognized gain (loss) if Sara sells the vehicle for $15,000.

What will be an ideal response?

a. ($1,000)

b. $0

c. $1,500

d. $1,500

a. The realized gain is the difference between the sales price - basis = $12,500 - $13,500 = ($1,000).

b. Personal losses are not recognized for tax purposes.

c. The realized gain is the difference between the sales price - basis = $15,000 - $13,500 = $1,500.

d. The recognized gain is $1,500. All gains from the sale of personal property are recognized for tax purposes.

You might also like to view...

A cultural production system is a ________

A) creative subsystem B) managerial subsystem C) communication subsystem D) all of the above

Identify the chromosomal abnormalities as well as the physical features present in a person suffering from Turner syndrome.

What will be an ideal response?

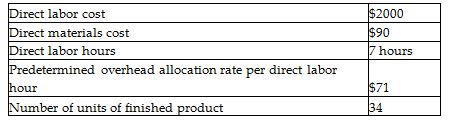

Haddows, Inc. completed Job GH6 last month. The cost details of GH6 are shown below.

Calculate the cost per unit of the finished product of Job GH6. (Round your answer to the nearest cent.)

A) $587.00

B) $17.26

C) $73.44

D) $76.09

For a firm, bank loans can be a source of cash and interest payments to the bank can be a use of cash

Indicate whether the statement is true or false.