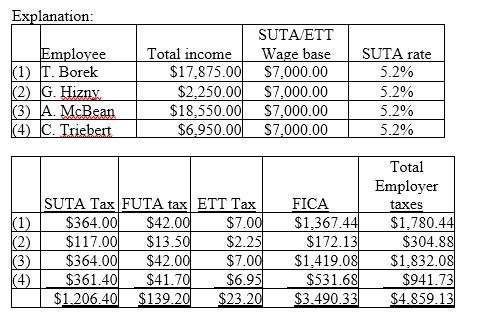

Concrete Works is a California company with a SUTA tax of 5.2% and a SUTA wage base of $7,000. The employee earnings for the past year are: T. Borek $17,875, G. Hizny $2,250, A. McBean $18,550, C. Triebert $6,950. California, employers pay an Employment Training Tax (ETT) of 0.1% on all wages up to the first $7,000 of wages. What are the employer-share taxes for FUTA, SUTA, ETT(.1%), and FICA for

the year? (ignore worker's compensation insurance)

A) $4,859.13

B) $5,349.23

C) $5,108.31

D) $4,835.91

A) $4,859.13

You might also like to view...

Balance theory helps explain why consumers like being linked to positively valued objects

Indicate whether the statement is true or false

The element of an advertisement that taps into or activates a person's value system is a(n):

A) message theme B) appeal C) executional framework D) leverage point

Outbound direct response telemarketing is most successful when it is tied into a database and either customers or prospects are contacted

Indicate whether the statement is true or false

Income tax expense when interperiod tax allocation is used creates a more stable effective tax rate over time relative to using tax payments as income tax expense.

Answer the following statement true (T) or false (F)