Financial instruments are different from money because they:

A. have greater liquidity.

B. can allow for the transfer of risk.

C. can act as a store of value and money cannot.

D. can't be a means of payment but money can.

Answer: B

You might also like to view...

? According to Figure 5-13, if the price of good X falls, the optimal combination will move

A. from U1to a point on a higher indifference curve, such as U3. B. from U2to a point on a higher indifference curve, such as U3. C. from U1to a point on a higher indifference curve, such as U3. D. from U2to a point on a higher indifference curve, such as U1.

Finite-sample distributions of the OLS estimator and t-statistics are complicated, unless

A) the regressors are all normally distributed. B) the regression errors are homoskedastic and normally distributed, conditional on X1,... Xn. C) the Gauss-Markov Theorem applies. D) the regressor is also endogenous.

A bank's secondary reserves include its

A. holdings of long-term bonds issued by large corporations. B. passbook saving account balances (a liability to the bank). C. holdings of corporate stock. D. holdings of 6-month Treasury bills.

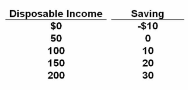

Refer to the given data. If plotted on a graph, the slope of the saving schedule would be:

A. .80.

B. .10.

C. .20.

D. .15.