Social Security is financed:

A. by state income tax revenues.

B. by payroll taxes on employees and employers.

C. by federal excise taxes.

D. out of general tax revenues.

Answer: B

You might also like to view...

The size of the expenditure multiplier is influenced by

i. the marginal propensity to consume. ii. autonomous spending. iii. the marginal tax rate. A) i only B) ii only C) iii only D) i and iii E) ii and iii

An ad valorem tax is

A. given as a proportion of the price. B. Latin for "buyer beware." C. identical to a unit tax. D. computed using the "inverse taxation rule."

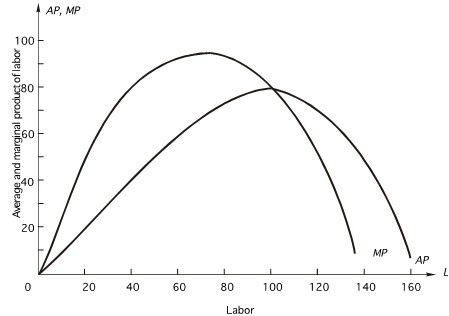

The following graph shows the marginal and average product curves for labor, the firm's only variable input. The monthly wage for labor is $2,800. Fixed cost is $160,000. When the firm uses 40 units of labor, how much output does it produce?

When the firm uses 40 units of labor, how much output does it produce?

A. 1,600 units B. 2,800 units C. 4,000 units D. 400 units E. none of the above

Suppose you come up with a wonderful new invention, and after borrowing as much as you can from a bank, you believe that additional capital is needed to make the invention marketable. Your small new company would be most likely to find additional capital from

A. a venture capital firm. B. an initial public offering. C. issuing bonds. D. borrowing from a different bank.