According to traditional Keynesian analysis, which has a greater impact on aggregate demand, changing taxes or changing government expenditures? Why?

An increase in government expenditures has a larger impact than a tax cut because a portion of the tax cut is saved.

You might also like to view...

The adverse selection problem is least likely in which of the following occupations?

a. lawyer b. barber c. college professor d. marketing analyst e. manager

Capital flight refers to

a. the movement of workers across international borders in response to exchange rate changes. b. the movement of funds between financial intermediaries when interest rates change. c. the ability of foreign direct investment to lift a country out of poverty. d. a large and sudden movement of funds out of a country.

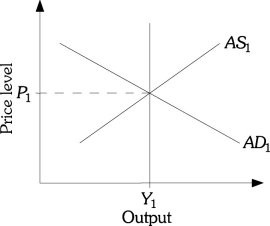

Refer to the information provided in Figure 32.2 below to answer the question(s) that follow. Figure 32.2Refer to Figure 32.2. According to the monetarists, a recession can be caused when

Figure 32.2Refer to Figure 32.2. According to the monetarists, a recession can be caused when

A. AS1 shifts to the left. B. AD1 shifts to the left. C. LRAS shifts to the left. D. AD1 shifts to the right.

DeShawn's Detailing is a service that details cars at the customers' homes or places of work. DeShawn's cost for a basic detailing package is $40, and he charges $75 for this service. For a total price of $90, DeShawn will also detail the car's engine, a

service that adds an additional $20 to the total cost of the package. Should DeShawn continue to offer the engine detailing service? A) Yes, he still makes a profit by selling the engine detailing service with the basic detailing package. B) yes, but only if he raises the price of the basic detailing package C) No, his marginal benefit is less than his marginal cost. D) More information is needed for DeShawn to make this decision.