If the expected path of one-year interest rates over the next five years is 4 percent, 5 percent, 7 percent, 8 percent, and 6 percent, then the expectations theory predicts that today's interest rate on the five-year bond is

A) 4 percent.

B) 5 percent.

C) 6 percent.

D) 7 percent.

C

You might also like to view...

If the Federal Reserve attempts to continue reducing unemployment by manipulating monetary policy, which of the following would you expect to see?

A) The rate of inflation will fall as the Fed tries to reduce the unemployment rate. B) The Fed's policies will be deflationary. C) The Fed's policies will be inflationary. D) The Fed will reduce the natural rate of unemployment.

Suppliers recognize there is a shortage in the market for their product when they notice that

a. the quantity supplied exceeds the quantity demanded. b. the quantity demanded is falling. c. inventories are falling. d. production exceeds new orders for the product. e. government economists announce a shortage exists.

According to the theory of comparative advantage, specialization and free trade will benefit

A. only that trading party that has both an absolute advantage and a comparative advantage in the production of all goods. B. only that trading party that has an absolute advantage in the production of all goods. C. only that trading party that has a comparative advantage in the production of all goods. D. all trading parties, even when some are absolutely more efficient producers than others.

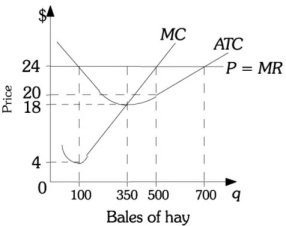

Refer to the information provided in Figure 8.9 below to answer the question(s) that follow.  Figure 8.9

Refer to Figure 8.9. At the market price of $18 per bale, if this farmer produces the profit-maximizing level of hay, the total revenue would be

Figure 8.9

Refer to Figure 8.9. At the market price of $18 per bale, if this farmer produces the profit-maximizing level of hay, the total revenue would be

A. $1,200. B. $2,800. C. $5,600. D. $6,300.