The freely floating exchange rate system has been in effect since

A. 1933.

B. 1943.

C. 1953.

D. 1973.

D. 1973.

You might also like to view...

Consider the following:

(i) When does the potential Pareto criterion reject a policy option? (ii) Explain why any policy that creates a deadweight loss will be rejected by the potential Pareto criterion. (iii) Would the competitive market outcome be rejected by the potential Pareto criterion? Why or why not?

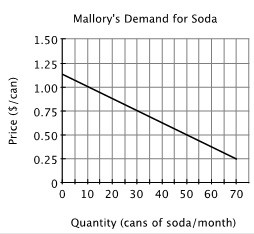

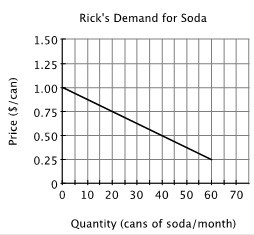

Refer to the figure below. If Mallory and Rick are the only two consumers in this market, then the market demand for soda will be 90 cans per week when the price of a can of soda is:

A. $1.50 B. $0.50 C. $1.25 D. $0.75

A nation can produce two products: steel and wheat. The table below is the nation's production possibilities schedule:Production Possibilities ScheduleProductABCDEFSteel012345Wheat100907555300A change from combination C to B means that

A. 2 units of steel are given up to get 75 units of wheat. B. 1 unit of steel is given up to get 15 more units of wheat. C. 1 unit of steel is given up to get 75 units of wheat. D. 2 units of steel are given up to get 15 more units of wheat.

Suppose you are given the following demand data for a product.PriceQuantity Demanded$1030940850760670The price elasticity of demand (based on the midpoint formula) when price decreases from $10 to $8 is

A. -1.60. B. -.63. C. -2.25. D. -1.16.