Sable Company is seeking a short-term loan from its local bank. The banker needs assurance that the company will be able to repay the loan. Describe three financial ratios the banker should consider including in the loan approval process. What information does each of your selected ratios provide?

What will be an ideal response?

Answers will vary

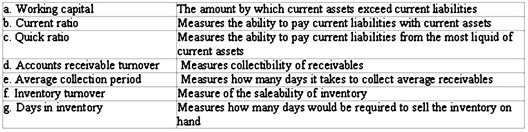

The banker needs to assess the short-term debt-paying ability of Sable Company. Consequently, the banker should calculate liquidity ratios.

Students should describe three of the following measures (ratios):

You might also like to view...

The _____ of a long-lived asset is the cost of a series of future services

a. present value of future cash flows b. acquisition cost c. current fair market value d. liquidation value e. current cost

Jean from Grandmas Cleaning Service was having trouble finding someone to fill one of the more menial positions in her company. Her brother-in-law put her contact with Lila who was in a car crash and could not find work after her brain injury. After testing Lila to see if she could perform the task of vacuuming successfully, she hired her. What part of diversity does this represent?

a. Age b. Race and ethnicity c. Gender d. Ability

Which of the following would be a disadvantage of manufacturer storage with direct shipping?

A) The ability to reduce cost of inventory by centralizing inventories at the manufacturer. B) The manufacturer has to postpone customization until after the customer order has been placed. C) Supply chains have to eliminate other warehousing space to save on the fixed cost of facilities. D) Response times tend to be large because the order has to be transmitted from the retailer to the manufacturer and shipping distances are on average longer from the manufacturer's centralized site.

What is earned value management and how can it be used to monitor project status?

What will be an ideal response?