What are the two essential functions banks perform for the economy, and why are they important?

What will be an ideal response?

Banks transfer money from savers to borrowers by holding deposits and lending excess reserves. Banks also create money by making loans of excess reserves. This lending activity changes the size of the money supply, which impacts the purchasing power available in the marketplace for buying goods and services.

You might also like to view...

By analyzing aggregate demand through its component parts, we can conclude that, everything else held constant, a decline in the inflation rate causes

A) an increase in real interest rates, an increase in investment spending, and a decline in aggregate output demand. B) a decline in real interest rates, a decrease in investment spending, and an increase in aggregate output demand. C) a decline in real interest rates, an increase in investment spending, and an increase in aggregate output demand. D) an increase in real interest rates, a decline in investment spending, and a decline in aggregate output demand.

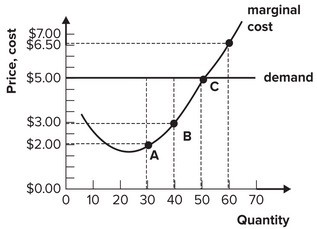

Refer to the graph shown. To maximize profit, this perfectly competitive firm should produce:

A. 30 units of output. B. 60 units of output. C. 50 units of output. D. 40 units of output.

The United States payroll tax is progressive.

Answer the following statement true (T) or false (F)

A consumer has two basic choices in making a trip: rent a car for $30.00 a day and spend two days of travel to the destination, or spend $400 for an airplane ticket and fly to the destination in two hours. The marginal utilities of the car rental and the airline ticket are the same. The consumer values time at $5 an hour. The rational consumer will most likely:

A. Rent a car B. Buy an airline ticket C. Find the full cost of the two modes to be equal D. Not make the trip