The coupon equivalent yield of a one-year Treasury bill with a $1,000 face value and a current price of $970 is __________ percent

A) 3.1

B) 3.0

C) 9.7

D) None of the above.

A

You might also like to view...

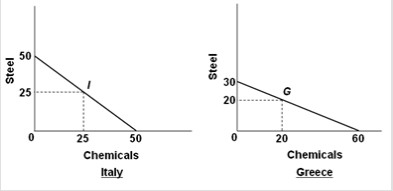

Suppose the world economy is composed of just two countries: Italy and Greece. Each can produce steel or chemicals, but at different levels of economic efficiency. The production possibilities frontiers for the two countries are shown in the graphs below. Assume that prior to specialization and trade, Italy and Greece preferred points I and G on their respective production possibilities frontiers. As a result of complete specialization according to comparative advantage, the resulting gains in total output will be

Assume that prior to specialization and trade, Italy and Greece preferred points I and G on their respective production possibilities frontiers. As a result of complete specialization according to comparative advantage, the resulting gains in total output will be

A. 10 units of chemicals. B. 5 units of steel and 15 units of chemicals. C. 25 units of steel. D. 15 units of steel and 5 units of chemicals.

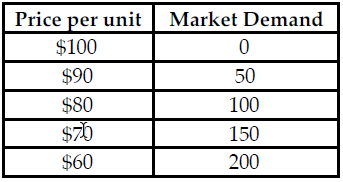

Refer to the table below. If this market is a Cournot Oligopoly and Firm X is produces 50 units, what is Firm Y's profit-maximizing quantity if their average total and marginal cost are constant and equal to $60?

The table above shows the market demand for a product that both Firm X and Firm Y manufacture. Both firms produce an identical product and the firms' average total and marginal cost are equal and constant.

A) 50 B) 100 C) 200 D) 150

The disadvantages of proprietorships include

A) limited liability for the owner. B) double taxation of business profits. C) the fact that the proprietorship can continue even after the owner dies. D) the fact that the proprietor is solely responsible for all the firm's debts.

After one year, a company will pay $5 in dividends. It commits to paying $5.30 two years from the current date. This growth rate for dividends is expected to continue indefinitely. The U.S. Treasury bond yield is 8% and the equity-risk premium is equal to 2.5%. Compute the required stock return and current price of this stock, using the dividend-discount model.

What will be an ideal response?