Expert Analysts Resources (EAR) has provided you with the following information about three companies you are currently evaluating: ? Company Degree of Operating Leverage (DOL) Degree of Financial Leverage (DFL) Acme 1.5× 6.0× Apex 3.0× 4.0× Alps 5.0× 2.0× ? Based on this information, which

firm is regarded as having the greatest overall risk?

A. Acme, because it has the highest degree of financial leverage (DFL).

B. Acme, because has the highest degree of total leverage (DTL).

C. Apex, because it has the highest degree of total leverage (DTL).

D. Alps, because it has the highest degree of operating leverage (DOL).

E. Acme, because it has the lowest degree of operating leverage (DOL).

Answer: C

You might also like to view...

Use exponential regression to provide an approximate model for the following data. Round your answer to two decimal places. t 1.80 4.50 6.98 9.70 11.97 y 19.83 14.03 10.03 7.67 5.59?

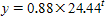

A. ?

B.

C. ?

D. ?

Divide.

A. 245

B. -

C. -5

D. 5

Find the volume of a cone with slant height of 10" and base radius of 6".

What will be an ideal response?

Write the expression in the standard form a + bi. 4

4

A. -4i B. 4i C. 4 D. -4