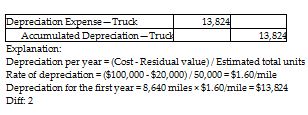

On January 1, 2019, a company acquired a truck for $100,000. Residual value was estimated to be $20,000. The truck can be driven for 50,000 miles over the next three years. Actual usage of the truck was recorded as 8,640 miles for the first year. Give the journal entry to record depreciation for the first year calculated as per the units-of-production method. (Do not round your intermediate calculations.)

What will be an ideal response?

You might also like to view...

Licensing and franchising are also known as ______.

a. contract manufacturing b. diversification c. cooperative contracts d. investments

________ reserves are identified for specific work packages and are distributed by the project manager and the team members.

Fill in the blank(s) with the appropriate word(s).

The following information is available from the current period financial statements of a company: Net income $150,000 Depreciation expense 28,000 Increase in accounts receivable 16,000 Decrease in accounts payable 21,000 The net cash flow from operating activities using the indirect method is:

A) $141,000. B) $173,000. C) $117,000. D) $215,000.

Robert has joined industry organizations, gained professional certifications, and contributed to industry publications. Robert is likely to be viewed as ________ by prospects.

A. efficient B. knowledgeable C. helpful D. punctual E. results-oriented