Allison buys equipment and pays cash of $50,000, signs a note of $10,000 and assumes a liability on the property for $3,000. In addition, Allison pays an installation cost of $500 and a delivery cost of $800. Allison's basis in the asset is

A) $60,000.

B) $63,000.

C) $63,500.

D) $64,300.

D) $64,300.

Basis includes all costs associated with acquiring an asset and placing it in service. $50,000 + $10,000 + $3,000 + $500 + $800 = $64,300

You might also like to view...

When a firm wants its coding system to convey meaning without reference to any other document, it would choose

a. an alphabetic code b. a mnemonic code c. a group code d. a block code

Open, honest communication is the single most important factor in successfully creating a Total Quality Management (TQM) environment

Indicate whether the statement is true or false

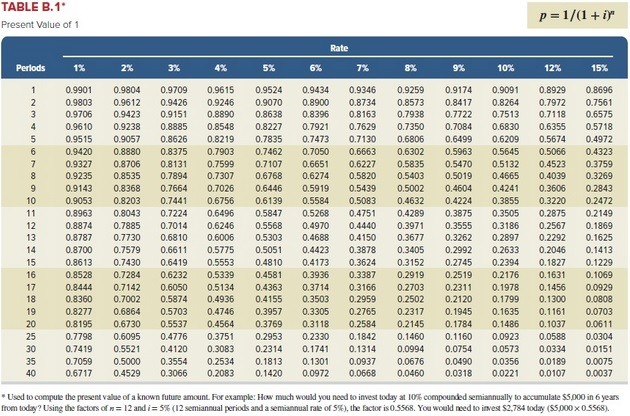

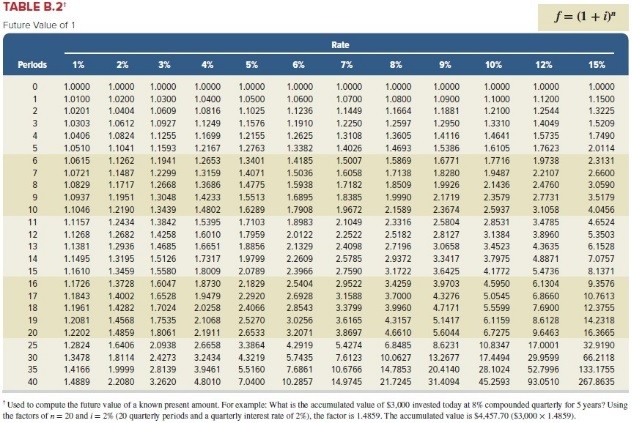

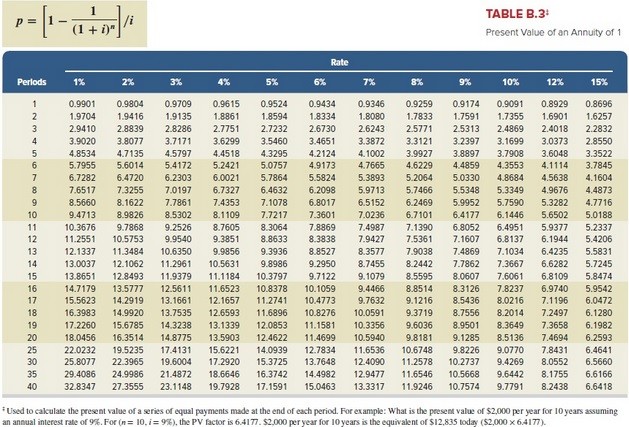

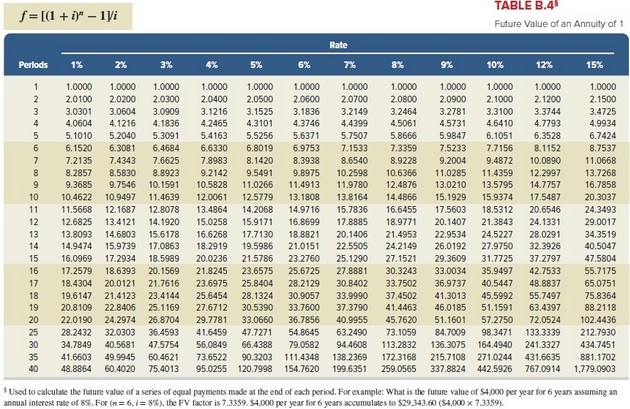

Paul wants to invest a sum of money today that will accumulate to $61,000 at the end of 4 years. Assuming he can earn an interest rate of 12% compounded semiannually, how much must he invest today? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use

Paul wants to invest a sum of money today that will accumulate to $61,000 at the end of 4 years. Assuming he can earn an interest rate of 12% compounded semiannually, how much must he invest today? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use

appropriate factor(s) from the tables provided.) A. $22,673 B. $38,271 C. $47,088 D. $38,562 E. $31,806

Sasha needs to select among three candidates for an open position in her department. She was most impressed by Randall's personality, values, and motivation to do the job well. However, a work sample test demonstrated that Randall does not have the skills necessary to perform the job, and Sasha does not have the luxury of training him on the job. Therefore, Randall is being eliminated from consideration because of __________ factors.

A. will-do B. can-do C. might-do D. should-do