When producers operate in a market characterized by negative externalities, a tax that forces them to internalize the externality will

a. give sellers the incentive to account for the external effects of their actions.

b. increase demand.

c. increase the amount of the commodity exchanged in market equilibrium.

d. restrict the producers' ability to take the costs of the externality into account when deciding how much to supply.

a

You might also like to view...

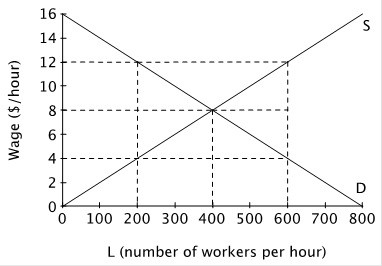

Consider the labor market below.  In the absence of any government intervention, the equilibrium wage is ________ per hour, and the equilibrium employment level is ________ workers per hour.

In the absence of any government intervention, the equilibrium wage is ________ per hour, and the equilibrium employment level is ________ workers per hour.

A. $4; 200 B. $12; 200 C. $8; 400 D. $12; 600

Today, producers changed their expectations about the future. This change

a. can cause a movement along a supply curve. b. can affect future supply, but not today's supply. c. can affect today's supply. d. cannot affect either today's supply or future supply.

The law of demand indicates that as the price of a good increases:

A. suppliers sell less of it. B. suppliers sell more of it. C. buyers want to buy less of it. D. buyers want to buy more of it.

In 2016, the face value of tickets to the Broadway musical Hamilton was

A) above the equilibrium price. B) below the equilibrium price. C) set exactly at the equilibrium price. D) lowered due to falling demand.