During the early 1980s, the U.S. economy experienced an increase in interest rates quoted on U.S. Treasury debt, business loans, and mortgages. At the same time the inflation rate gradually declined more than expected. What happened to ex ante versus ex post real interest rates during this period? Use the Fisher equation to support your answer.

What will be an ideal response?

The Fisher equation is: i = r + ?e.

The Fisher equation can be used to compute the ex ante real interest rate. The ex post real interest rate is computed using actual inflation in place of expected inflation. If nominal interest rates increase and the inflation rate decreased, this implies the ex post real interest rate must have decreased. If inflation declined more than expected, this would imply that the ex post real interest rate exceeded the ex ante real interest rate.

You might also like to view...

When is price fixing among competitors not a violation of the antitrust laws?

A) Price fixing among competitors is always a violation of the antitrust law. B) when a cartel can maximize profit without behaving like a monopoly C) when price fixing leads to a more efficient outcome D) when price fixing does not result in predatory pricing

The assumption of diminishing marginal rate of substitution means that

A) the budget line has a negative slope. B) the budget line does not shift when people's preferences change. C) indifference curves might have a positive slope. D) indifference curves will be concave.

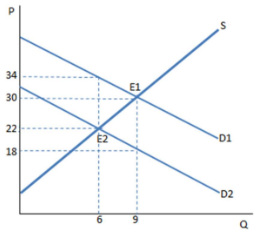

The graph shown demonstrates a tax on buyers. Which of the following can be said about the effect of this tax?

A. The tax creates a shortage, and rationing must occur.

B. The tax creates a surplus, and the government must buy the excess.

C. The tax creates a shortage, and the government must regulate the market.

D. None of these is true

The classical theory of inflation:

A. describes a long-run equilibrium. B. explains the direct relationship between money supply and the price level. C. shows neutrality of money in the long run. D. All of these statements are true.