On January 1, Year 2, Burton Company had a balance in Accounts Receivable of $90,000 and a balance in the Allowance for Doubtful Accounts account of $2,400. Burton had credit sales of $244,000 during Year 2 and ended the year with a balance in Accounts Receivable of $48,000. Burton also wrote off $1,100 of receivables during Year 2. Burton uses the allowance method and assumes that 2% of the sales on account will not be collected.Required:a) After adjustments at the end of Year 2, what will be the balance in the Allowance for Doubtful Accounts?b) What was the decrease in the net realizable value of accounts receivable in Year 2 as a result of the write-off of the receivable?c) What amount of cash was collected from customers during Year 2?

What will be an ideal response?

a) $6,180

b) $0

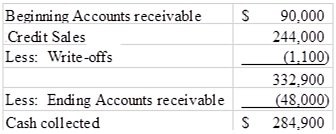

c) $284,900

a) Ending allowance for doubtful accounts = Beginning allowance for doubtful accounts of $2,400 + Uncollectible accounts expense of ($244,000 × 2%) - Write-off of $1,100 = $6,180

b) Net realizable value = Accounts receivable - Allowance for doubtful accounts

Write-offs do not affect net realizable value because they decrease both accounts receivable and the allowance for doubtful accounts by the same amount.

c)

You might also like to view...

A manager assessing the organization's access to capital is involved in analysis of

A. strengths. B. weaknesses. C. opportunities. D. threats. E. strengths or weaknesses depending on the outcome of the assessment.

Individuals who are high trusters are more apt to believe communications from others without questioning their validity and are more gullible than low-trust individuals.

Answer the following statement true (T) or false (F)

The ______ staffing strategy of multinational organizations involves using a mix of nationalities within regions.

A. polycentric B. ethnocentric C. geocentric D. regiocentric

Garments must be labeled with the country of manufacture, fabric content, and

A. clothing style. B. size. C. inspection code. D. care instructions. E. universal product code.