According to this Application, a common belief is that fiscal multipliers are ________ during ________

A) larger; recessions B) of equal size; recessions and growth periods

C) smaller; growth periods D) smaller; recessions

D

You might also like to view...

The liquidity premium theory holds that investors

A) always choose the bond with the highest expected return, regardless of maturity. B) require a term premium to compensate them for investing in a less preferred maturity. C) view bonds of different maturities as perfect substitutes. D) view bonds of different maturities as completely unsubstitutable.

When a negative externality exists in a market, total surplus:

A. is decreased by deadweight loss compared to that same market without a negative externality. B. is the same as a market without a negative externality. C. is increased by deadweight gain compared to that same market without a negative externality. D. is the same but re-distributed differently than if that same market did not have a negative externality.

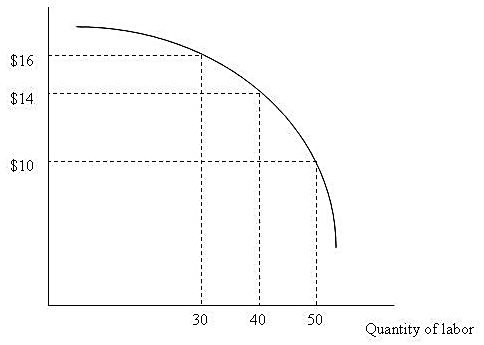

Figure 10.1 depicts a firm's marginal revenue product curve. If the prevailing hourly wage decreases:

Figure 10.1 depicts a firm's marginal revenue product curve. If the prevailing hourly wage decreases:

A. the marginal revenue product curve shifts upward. B. the marginal revenue product curve shifts downward. C. the marginal revenue product curve does not shift, but there is a movement upward along the curve. D. the marginal revenue product curve does not shift, but there is a movement downward along the curve.

The initial impact of the Fed's open market sale of government securities by the Federal Reserve is

A. an increase in commercial bank deposits at the Fed. B. a fall in the money supply by some multiple of the dollar volume of the sale. C. an increase in the money supply by some multiple of the dollar volume of the sale. D. a reduction of the commercial banking system's reserve deposits at the Fed.