A tax is progressive if the ratio of taxes to income rises as income rises.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Who benefits from a tariff on a good?

A) domestic consumers of the good B) foreign governments C) domestic producers of the good D) foreign producers of the good

After graduation from college you will receive a substantial increase in your income from a new job. If you decide that you will purchase more T-bone steak and less hamburger, then for you hamburger would be considered a(n):

A) normal good. B) substitute good. C) complementary good. D) inferior good.

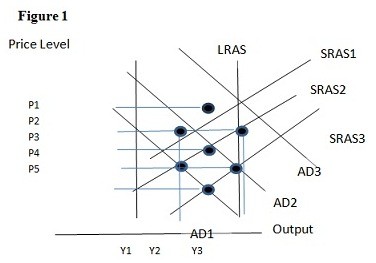

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

Recall the Application about the price and supply of blueberries to answer the following question(s).According to the Application, as the quantity of blueberries demanded increases, prices ________ in the short run and ________ as supply catches up with demand.

A. rise; stabilize B. fall; stabilize C. rise; fall D. fall; rise