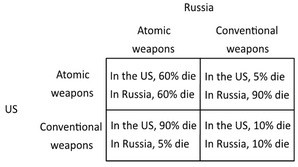

The following payoff matrix shows the outcomes for the United States and Russia from relying on conventional weapons versus atomic weapons in a military conflict. The percentages refer to the fraction of the population that would die. The Nash equilibrium outcome of this game is for:

The Nash equilibrium outcome of this game is for:

A. both countries to have conventional weapons.

B. both countries to have atomic weapons.

C. the U.S. to have atomic weapons and Russia to have conventional weapons.

D. Russia to have atomic weapons and the U.S. to have conventional weapons.

Answer: B

You might also like to view...

Which of the following is NOT a determinant of the demand for gasoline?

A. Consumers' incomes. B. The price of automobiles. C. The supply of gasoline. D. The price of diesel.

In utilizing unconventional monetary policy in 2009, the Federal Reserve purchased

a. real estate worth more than $2 trillion. b. $800 billion in Treasury bills. c. over $1 trillion in mortgage backed securities. d. $600 billion in long-term Treasury bonds.

For consumers, most market activity can be explained by the goal of:

A.) Charitable responsibility. B.) Maximizing income. C.) Profit maximization. D.) Maximizing happiness.

In Macroland, potential output equals $100 trillion and the natural rate of unemployment is 4 percent. If the actual unemployment rate is 5 percent, then real GDP must be:

A. $96 trillion. B. $104 trillion. C. $98 trillion. D. $102 trillion.