The economic inefficiency of a monopolist can be measured by the

a. number of consumers who are unable to purchase the product because of its high price.

b. excess profit generated by monopoly firms.

c. poor quality of service offered by monopoly firms.

d. deadweight loss.

d

You might also like to view...

Currently. the price of consuming housing src="https://sciemce.com/media/3/ppg__cognero__Chapter_06_Doing_the_quot_Best_quot_We_Can__media__3e7add47-491f-48be-8fcb-fd865a8ddf80.PNG" style="vertical-align: -8px;" width="17px" height="28px" align="absmiddle" />. At the same time, the government lowers the tax on other consumption, lowering the price from

a. Write down your original budget constraint assuming the consumer has income I.

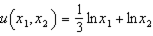

b. Suppose the utility function

c. How much housing and other goods will this consumer consume prior to any policy change?

d. When the policy change goes into effect, will this consumer still be able to afford the bundle you derived in (c)?

e. When the policy change goes into effect, what bundle will the consumer consume?

What will be an ideal response?

According to the loanable funds model, which of the following events would result in higher interest rates and greater saving?

a. Firms become pessimistic about the future and, as a result, they cut back on their plans to buy new equipment and build new factories. b. The government goes from running a budget deficit to running a budget surplus. c. Congress passes a reform of the tax laws that encourages greater saving. d. Congress passes a reform of the tax laws that encourages greater investment.

The shortest of the three lags for monetary policy is

A) the impact lag. B) the implementation lag. C) the government lag. D) the recognition lag.

If the expected future earnings of a company goes up, you would expect the price of its stock to

A. rise. B. fall. C. be unaffected. D. fall to zero.