The empirical evidence on purchasing power parity over the long run seems to point out that:

A. the theory of purchasing power parity cannot explain long-run changes in exchange rates.

B. the higher a country's inflation rate the greater is the depreciation in the country's currency.

C. the higher a country's inflation rate, the greater is the appreciation in the country's currency.

D. there isn't any clear link between inflation rates and exchange rates.

Answer: B

You might also like to view...

A call option gives the owner the

A) right to sell the underlying security. B) obligation to sell the underlying security. C) right to buy the underlying security. D) obligation to buy the underlying security.

The rental rate approach to investment choices by firms and the present value approach

a. always agree. b. agree only if depreciation is 0. c. agree only if the price of equipment does not change. d. agree only when inflation rates are zero.

Two of the economy's most important financial intermediaries are

a. suppliers of funds and demanders of funds. b. banks and the bond market. c. the stock market and the bond market. d. banks and mutual funds.

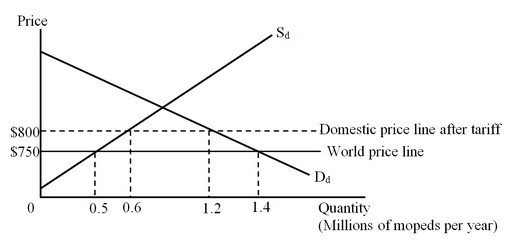

The figure below shows the national market for mopeds in a country. Dd and Sd are the domestic demand and supply curves of mopeds, respectively. Calculate the welfare loss arising from the consumption effect of the tariff.

Calculate the welfare loss arising from the consumption effect of the tariff.

A. $14 million B. $5 million C. $2.5 million D. $7.5 million