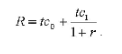

Assume two people, Tom and Rose, live for two periods and are taxed on consumption in both periods. In period 0, Rose has consumption of 50. In period 1, Rose has consumption of 50. Tom has consumption of 40 in period 0. Use the formula below for lifetime consumption tax liability, R i , to find out what Tom's period 1 consumption must be, to ensure that tax liabilities between the two are equal, if the consumption tax rate is 9% and the rate of interest is 4%,

Set these equations equal for each person such that:

You might also like to view...

If the marginal propensity to consume (MPC) is 0.75 and there is an increase in planned investment spending of $0.5 trillion, then saving will

A) increase by $0.25 trillion. B) increase by $0.5 trillion. C) increase by $1 trillion. D) remain unchanged.

The price effect describes the:

A. decrease in the quantity of labor supplied in response to a higher wage. B. increase in the quantity of labor supplied in response to a lower wage. C. increase in the quantity of labor supplied in response to a higher wage. D. increase in the quantity of labor demanded in respond to a higher wage.

Unlike an internally held public debt, an externally held public debt

a. cannot pass the debt burden on to future generations b. can pass the debt burden on to future generations c. expires upon maturity d. cannot be reduced because foreigners hold the debt e. causes crowding out

Suppose the labor-force participation rate of men is greater in Troy than in Sparta. This could be because the men of Troy

a. spend more time in school and have earlier and longer retirements than men in Sparta. b. spend more time in school and have later and shorter retirements than men in Sparta. c. spend less time in school and have earlier and longer retirements than men in Sparta. d. spend less time in school and have later and shorter retirements than men in Sparta.