A college received a contribution to its endowment fund of $2 million. They can never touch the principal, but they can use the earnings. At an assumed interest rate of 9.5 percent, how much can the college earn to help its operations each year?

A) $95,000

B) $19,000

C) $190,000

D) $18,000

E) $9,500

C

You might also like to view...

Credits in the factory overhead account represent the overhead applied to production

Indicate whether the statement is true or false

One of the distinguishing features of the Australian labor relations systems since the 1980s has been:

A. The number of union mergers and amalgamations B. A trend toward voluntarism C. Frequent strikes D. Growing union density rates

Age does not affect how they prefer to learn.

Answer the following statement true (T) or false (F)

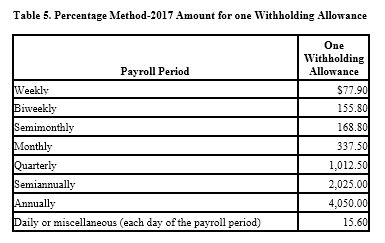

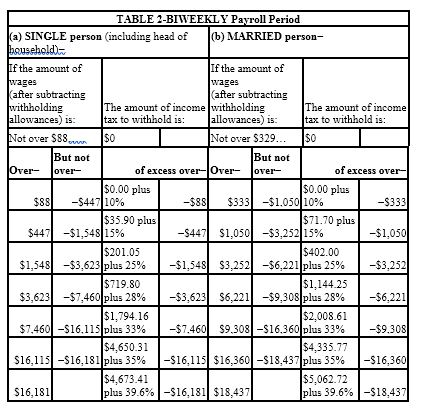

Amanda is a full-time exempt employee in Sparks, Nevada, who earns $84,000 annually. She is married with 1 deduction and is paid biweekly. She contributes $150.00 per pay period to her 401(k) and has pre-tax health insurance and AFLAC deductions of $50.00 and $75.00, respectively. Amanda contributes $25.00 per pay period to the United Way. What is her net pay? (Use the percentage method. Do not

round intermediate calculations. Round final answers to 2 decimal places.)

A) $2,394.47

B) $2,193.60

C) $2,358.98

D) $2,605.44