The Social Security tax is

A. A progressive tax.

B. A proportional tax at low income levels and a progressive tax at higher income levels.

C. A regressive tax.

D. A proportional tax.

Answer: C

You might also like to view...

By polling people, we can calculate the demand for public goods and have the market provide them. But we don't. Instead, we allow the government to pay for and provide those goods because it

a. knows better than individuals what public goods are desirable b. avoids "special interests" interference in the market c. can avoid all negative and positive externalities d. can tax people to finance the production of public goods and thereby prevent freeriders e. can prevent market failure

Consider two people, Sandy Roos, who earns $25,000 . and Gary Behrman, who earns $50,000 . If the current flat-tax rate is 20 percent, then

a. Gary would prefer a poll tax to a flat tax b. Sandy would prefer a poll tax to a flat tax c. Gary and Sandy both pay the same amount of tax d. Sandy would prefer the flat tax to a progressive income tax e. Gary would prefer a progressive income tax to the flat tax

The long run is characterized by:

A. the relevance of the law of diminishing returns. B. at least one fixed input. C. the ability of the firm to change its plant size. D. insufficient time for firms to enter or leave the industry.

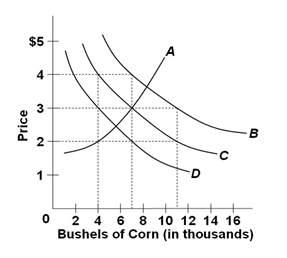

Refer to the graph below. Which curve shows a direct relationship between price and quantity?

A. A

B. B

C. C

D. D