Under the terms of their divorce agreement executed in August of this year, Clint transferred Beta, Inc. stock to his former wife, Rosa, as a property settlement. At the time of the transfer, the stock had a basis to Clint of $55,000 and a fair market value of $68,000. Rosa subsequently sold the stock for $75,000. What is the tax consequence of first the stock transfer and then the stock sale to

Rosa?

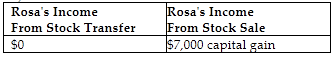

A)

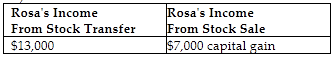

B)

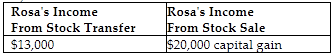

C)

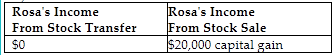

D)

A)

The stock transfer has no tax consequences because it is a property settlement. Rosa's basis in the stock is $55,000, the carryover basis from Clint. Thus, her gain on the sale is $20,000 ($75,000 - $55,000).

You might also like to view...

Howard Stringer, a native of the United Kingdom, is Chairman of:

A) Nissan Motor (Japan). B) Pearson PLC (Great Britain). C) Ford Motor Company (USA). D) Sony (Japan). E) Atlas Copco AB (Sweden).

In discriminant analysis, the value of the coefficient for a particular predictor depends on the other predictors included in the discriminant function

Indicate whether the statement is true or false

If there are fewer than twelve (12) creditors, an involuntary petition must be signed by at least three (3) creditors.

Answer the following statement true (T) or false (F)

A variance is the difference between standard costs and actual costs

Indicate whether the statement is true or false