During the current year, Don's aunt Natalie gave him a house. At the time of the gift, the house had a FMV of $145,000 and his aunt's adjusted basis was $134,000. After deducting the annual exclusion, the amount of the gift was $130,000. His aunt paid a gift tax of $20,000 on the house. What is Don's basis in the house for purposes of determining gain?

A. $130,000

B. $145,000

C. $134,000

D. $135,692

Answer: D

You might also like to view...

MFL Sales expects to sell 460 units of Product A and 450 units of Product B each day at an average price of $15 for Product A and $33 for Product B The expected cost for Product A is 38% of its selling price and the expected cost for Product B is 57% of its selling price. MFL Sales has no beginning inventory, but it wants to have a six-day supply of ending inventory for each product. Compute the budgeted cost of goods sold for the next (seven-day) week. (Round the answer to the nearest dollar.)

A) $67,032 B) $66,519 C) $130,500 D) $77,606

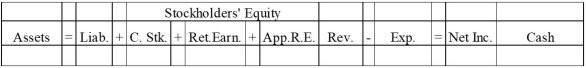

On December 15, Year 1, the Binghamton Corporation established a retained earnings appropriation of $20,000 for future expansion. The balance of the retained earnings account prior to the transaction was $60,000. At December 31, Year 1, the Corporation had 2,000 shares of $10 par common stock (issued at par) outstanding. The corporate charter indicates 20,000 shares of common stock are authorized and there is no treasury stock.Required:a) Indicate the effect of the appropriation on the financial statements. b) Prepare the Stockholder's Equity section of the Binghamton Corporation's Balance sheet of December 31, Year 1.

b) Prepare the Stockholder's Equity section of the Binghamton Corporation's Balance sheet of December 31, Year 1.

What will be an ideal response?

A manufacturer of snow shovels sees a drop in the demand for snow shovels due to an unseasonally warm winter. This means that the demand experiences

A) random variation. B) nonrandom variation. C) seasonal variation. D) no variation.

Mason Towel uses the units-of-production method of depreciation. A new knitting machine was purchased for $22,500 . It will produce an estimated 800,00 . units in its life and has an estimated scrap value of $2,500 . It produced 150,00 . units in the first year. Compute the book value at the end of the first year