Suppose the exchange rate between the U.S. dollar and the Mexican peso was $1 = 5 pesos. A can of Pepsi sells for $2 in Boston and for 12 pesos in Mexico City

A) Purchasing power parity prevails with these prices.

B) Purchasing power parity does not prevail with these prices.

C) The U.S. dollar would be expected to depreciate.

D) None of the above answers is correct.

B

You might also like to view...

According to the theory of purchasing power parity, the exchange rate between two countries reflects

A) the interest rates in the two countries. B) the unemployment rates in the two countries. C) government spending in the two countries. D) differences in the overall price levels in the two countries.

A 7.25 percent sales tax

A. Is a regressive tax because poor individuals consume a higher percentage of their income than high-income individuals. B. Does not impose an additional tax burden on most individuals because the sales tax is paid entirely by the seller. C. Is a progressive tax because high-income individuals buy more goods and services than low-income individuals. D. Is a proportional tax because the rate is the same for all income groups.

Market failure may lead to

A. Production possibilities. B. The absence of externalities. C. An equitable distribution of goods and services. D. Public goods being underproduced.

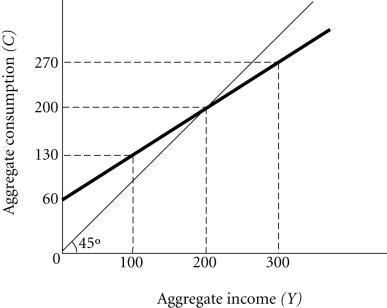

Refer to the information provided in Figure 23.3 below to answer the question(s) that follow. Figure 23.3Refer to Figure 23.3. [-60 + 0.3Y] is this society's

Figure 23.3Refer to Figure 23.3. [-60 + 0.3Y] is this society's

A. MPC. B. saving function. C. consumption function. D. MPS.