A liquidation must be reported to the Internal Revenue Service on Form 966

A. whether the shareholders' realized gain is recognized or not.

B. by the shareholders.

C. within 60 days of the adoption of a plan of liquidation.

D. that is filed with the national IRS office.

Answer: A

You might also like to view...

Will owes Jenny $1,000. Brad owes Will $1,000. Will unconditionally assigns his rights to Jenny. Will's right to the $1,000 is then A) unchanged

B) extinguished. C) incidental. D) assigned to a court.

Limitations of online travel services include

A) limited amount of free information. B) substantial discounts. C) the difficulty of using virtual travel agents can be very large. D) increases in provider's commission and its processing.

Which of the following best describes an attribute or combination of attributes that could be used as the primary key for an entity?

A) Candidate key B) Natural key C) Surrogate key D) Composite key

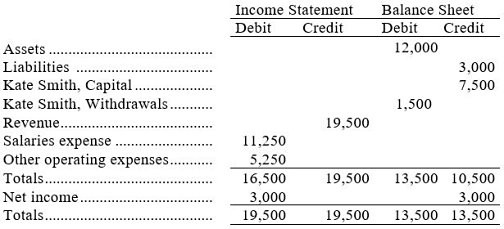

A company's December 31 work sheet appears below with summary amounts in the Income Statement and Balance Sheet columns. Prepare the four necessary closing entries.

What will be an ideal response?