The difference between U.S. financial regulation between the 1930s-to-1980 period and the 1980-to-2010 period is:

a. The earlier period was characterized by heavy government regulations and the later one was characterized by looser government regulations.

b.The earlier period was characterized by heavy use of the originate-to-distribute" strategy.

c. The earlier period was characterized by recurring, nation-wide speculative housing bubbles.

d. The earlier period was characterized by heavy use of securitization.

e. All of the above.

.A

You might also like to view...

Is monopolistic competition efficient?

What will be an ideal response?

Why is the real-world deposit multiplier smaller than 1/RR, where RR is the required reserve ratio?

What will be an ideal response?

The standard deviation of a two-asset portfolio (with a risky and a non-risky asset) is equal to

A) the fraction invested in the risky asset times the standard deviation of the non-risky asset. B) the fraction invested in the non-risky asset times the standard deviation of the risky asset. C) the fraction invested in the risky asset times the standard deviation of that asset. D) the fraction invested in the non-risky asset times the standard deviation of that asset.

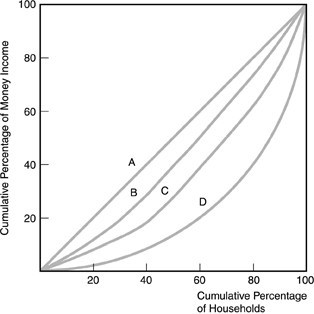

Refer to the above figure. Perfect income equality is shown by

Refer to the above figure. Perfect income equality is shown by

A. curve A. B. the horizontal axis. C. the vertical axis. D. curve D.