Discuss the effects on the current price of a stock from each of the following:a) An increase in the growth rate of the dividend;b) A decrease in the risk-free interest rate;c) An increase in the equity-risk premium; and finallyd) A decrease in the annual dividend.

What will be an ideal response?

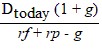

We can use the dividend-discount model to think through our answers:

Ptoday =

where Dtoday is the current dividend; rf is the risk-free rate; rp is the risk premium; g is growth rate of the dividend; we are measuring the impact on Ptoday. From the formula we see that an increase in g will cause Ptoday to increase. In addition, a decrease in rf will also cause Ptoday to increase. An increase in rp on the other hand will reduce Ptoday as will a decrease in the annual dividend.

You might also like to view...

The time and money spent in carrying out financial transactions are called

A) economies of scale. B) financial intermediation. C) liquidity services. D) transaction costs.

Under fiscal stabilization policy in the New Keynesian model, after a negative shock to output,

A) the government increases expenditures and the central bank increases the money supply. B) the government increases expenditures and the central bank decreases the money supply. C) the government decreases expenditures and the central bank increases the money supply. D) the government decreases expenditures and the central bank decreases the money supply.

Helping the poor is not necessarily the same thing as promoting greater equality

a. True b. False

Compared to a sales tax, a value-added tax is _____

a. easier to calculate b. harder to collect c. easier to apply to investment goods d. easier to monitor