How does inclusion of the current revenues and expenditures of the Social Security trust fund into the budget calculation affect the reported budget deficit of the federal government?

A. It increases the reported deficit.

B. It reduces the reported deficit.

C. It exerts no effect on the reported deficit.

D. It increases the deficit during an economic boom but reduces it during a recession.

Answer: B

You might also like to view...

A recent accounting graduate from a major business school is searching for a place to begin his career as an accountant. This individual is best considered as

A) structurally unemployed. B) seasonally unemployed. C) cyclically unemployed. D) frictionally unemployed.

A consumer is currently spending all of her available income on two goods: music CDs and DVDs. At her current consumption bundle, she is spending twice as much on CDs as she is on DVDs. If the consumer has $120 of income and is consuming 10 CDs and 2 DVDs, what is the price of a CD?

a. $4 b. $8 c. $12 d. $20

"Monetary policy can be described either in terms of the money supply or in terms of the interest rate.". This statement amounts to the assertion that

a. rightward shifts of the money-supply curve cannot occur if the Federal Reserve decides to target an interest rate. b. the activities of the Federal Reserve's bond traders are irrelevant if the Federal Reserve decides to target an interest rate. c. changes in monetary policy aimed at expanding aggregate demand can be described either as increasing the money supply or as increasing the interest rate. d. our analysis of monetary policy is not fundamentally altered if the Federal Reserve decides to target an interest rate.

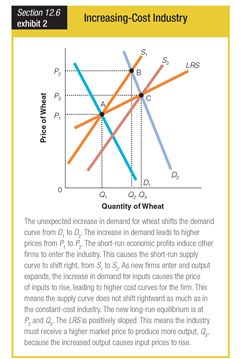

What most likely causes the supply curve to shift from S1 to S2?

a. an increase in demand for a product

b. an increase in market price

c. an increase in firms entering the market

d. an increase in quantity sold