The use of fiscal policy to stabilize the economy is limited because

A) changes in government spending and tax rates have a small effect on aggregate demand.

B) changes in government spending and tax rates have a small effect on interest rates.

C) the legislative process can be slow, which means that it is difficult to make fiscal policy actions in a timely way.

D) the Internal Revenue Service (IRS) resists changes in tax rates because of all the changes they would have to make to the tax code.

Answer: C

You might also like to view...

Tuesday also turns out to be the busiest day for ___________ ticket sales and the __________ of the workweek.

Fill in the blank(s) with the appropriate word(s).

The total indebtedness of the federal government in the form of outstanding interest-earning bonds is the

What will be an ideal response?

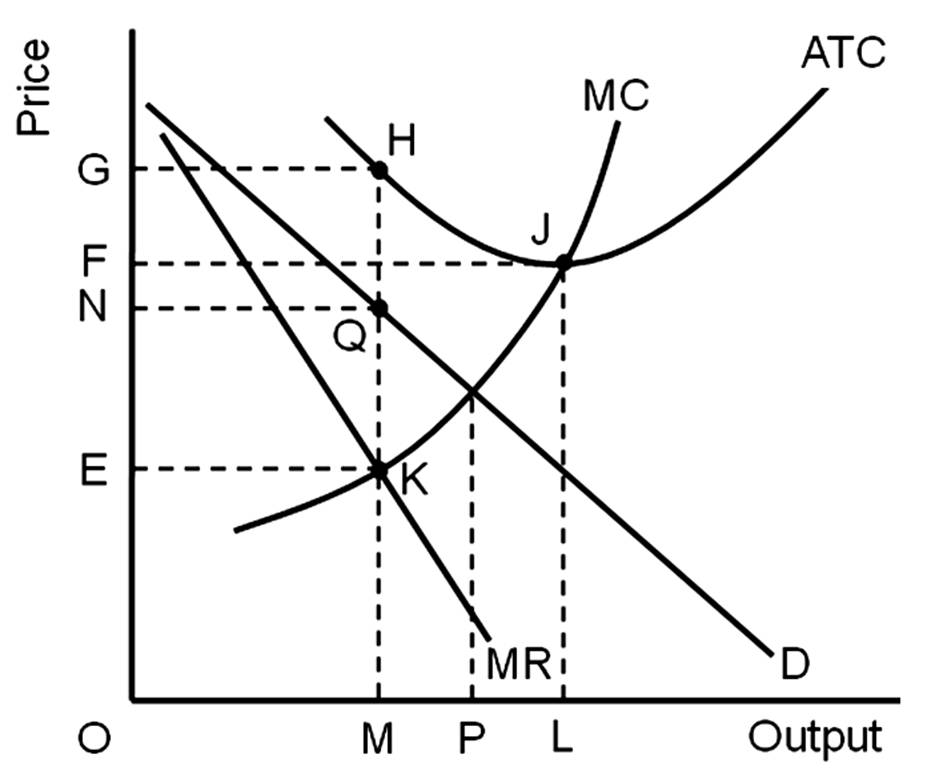

The loss-minimizing firm will be earning total revenue of

A. OMHG.

B. OLJF.

C. OMQN.

D. EKHG.

Household income is ________ related to consumption and ________ related to household saving.

A. negatively; negatively B. positively; positively C. negatively; positively D. positively; negatively