Suppose you are Joe -- one of many souvenir shop owners in a town centered around tourism. All souvenir shop owners face the same decreasing returns to scale production technology as well as recurring annual fixed costs, and they all sell a single local novelty x that is identical across all shops. Assume at the outset of each part below that the souvenir shop market in this town is in long run equilibrium and treat each part separately - i.e. do not carry what you concluded in one part into the next - except for part (e) where you are explicitly asked to continue with the set-up in part (d).

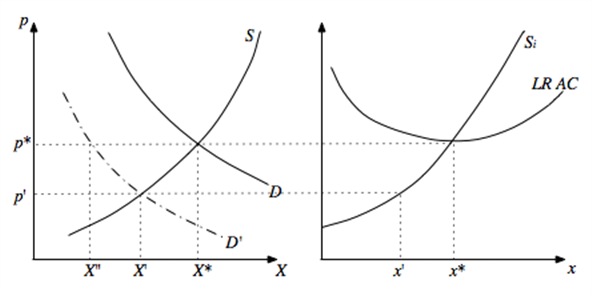

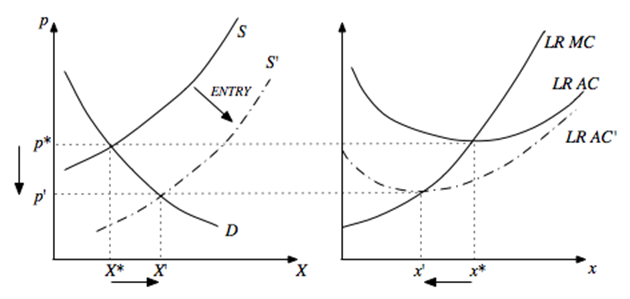

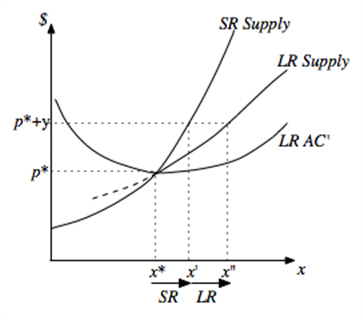

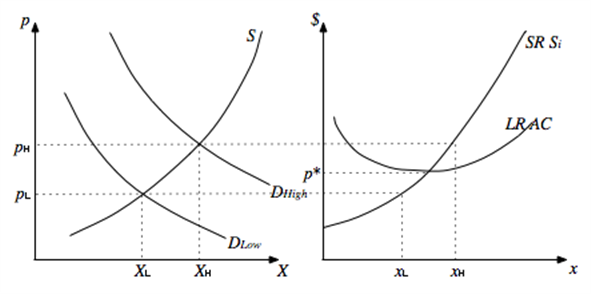

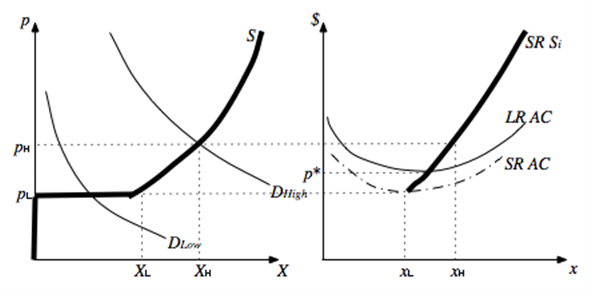

a. The Disney Corporation has set up a new theme park in a town 20 miles away and, as a result, a fraction of tourists that used to stay in your town are now staying elsewhere on their vacation. What happens to your price and output in the market and in Joe's business in the short and long run (assuming that you remain open for business)? Can you tell whether the number of souvenir shops in your town increases or decreases?b. A new mayor in your town lowers recurring annual business license fees. What happens to the price and output in the market and Joe's business in the short and long run? Will the number of souvenir shops in the town increase or decrease?c. A local reporter discovers that the famous "Joe the Plummer" is a distant cousin of yours - and you convince your cousin Joe to join you in your business. The newly renamed souvenir shop, "Joe and Joe", is featured on national television after a visit by "Joe the Vice-President", and you decide to stamp "Greetings from Joe, Joe & Joe" on all of your merchandise. As a result, tourists are willing to pay $y more for your x than they would be willing to pay at any non-Joe store where x does not contain the coveted "Greetings from Joe, Joe & Joe" stamp. How does your output change in the short and long run (assuming capital is fixed in the short run but not in the long run and assuming it costs nothing to put the stamp on your products)?d. Suppose this town is located on the beach in North Carolina where there is a "high season" during the 6 warm months of the year and a "low season" during the 6 cool months of the year. Demand is high during the high season and low during the low season. On two recent visits to this town - one in the summer and one in the winter -- I noticed that prices for x where considerably higher during the high season. Explain how two different prices in different seasons could exist in an industry that is in long run equilibrium. Use side-by-side graphs of the market and Joe's business in your explanation, illustrating both the high demand DH and the low demand DL in the market. How do these different prices relate to the lowest point of the long run AC curve at Joe's business?e. Suppose that I noticed one other thing on my recent two visits to this town: only half the souvenir shops are open in the winter while all are open in the summer. Is this compatible with our assumption that souvenir shops face decreasing returns to scale throughout (and no short run fixed costs)? (Hint: Think about what must be true for half the shops to close for 6 months - and what this implies for short run cost curves and shut down prices.)

What will be an ideal response?

b. Nothing happens in the SR since license fees are sunk "costs" in the SR. In the LR, AC shifts down without the long run MC curve changing -- so the lowest point of the LR AC curve shifts down and to the left. Price falls to p' -- causing market output to rise to X' and each firm to reduce output to x'. This implies that firms must have entered -- and the number of firms has increased.

c. Nothing changes in the market -- so p* remains unchanged. But Joe&Joe can now charge (p*+y). This leads to an increase in output by Joe&Joe from x* to x' in the SR and a further increase to x" in the LR when Joe&Joe can adjust capital.

d. Each firm produces

in the low season and x* in the high season. In order for firms to be making zero long run profit (which is necessary in long run equilibrium),

in the low season and x* in the high season. In order for firms to be making zero long run profit (which is necessary in long run equilibrium),  has to fall below p* and

has to fall below p* and  has to fall above p*. Firms then make positive SR profit in the low season but negative LR profit -- which is exactly offset in the high season when firms make positive LR profit. This is a long run equilibrium because firms make zero annual LR profit and thus no firm wants to enter or exit.

has to fall above p*. Firms then make positive SR profit in the low season but negative LR profit -- which is exactly offset in the high season when firms make positive LR profit. This is a long run equilibrium because firms make zero annual LR profit and thus no firm wants to enter or exit.

e. If some firms shut down and some stay open in the low season, it must be that firms are indifferent between shutting down and staying open in the low season. Thus, the firms that stay open must be making zero SR profit in the low season -- which means their price must be equal to the shut-down price at the lowest point of their SR AC curve. At that price, the market produces

, with some firms producing

, with some firms producing  and other firms producing zero in the low season. (To make up for the negative LR profit from the low season, it must also be the case, as in part (d), that the high season price

and other firms producing zero in the low season. (To make up for the negative LR profit from the low season, it must also be the case, as in part (d), that the high season price  lies above long run AC.)

lies above long run AC.)This is not compatible with the assumption that firms face decreasing returns throughout (and no SR fixed costs). If this were the case, then the SR MC curve would be upward sloping throughout, with SR AC curves sharing the same vertical intercept but lying under the SR MC curves throughout. This would imply a shut-down price at which all firms would produce zero -- and would not allow for the observation of some firms producing and others shutting down in the low season. For this to happen, we need U-shaped SR AC curves -- for which we need initially increasing marginal product of labor which in turn implies increasing returns to scale at low levels of output.

You might also like to view...

Which of the following is FALSE regarding unions?

A) The American Federation of Labor (AFL), composed of craft unions, was formed in 1886 under the leadership of Samuel Gompers. B) For a period after World War I the government temporarily stopped protecting labor's right to organize. C) During the Great Depression, legislation was passed that made collective bargaining illegal. D) The AFL and the CIO merged in 1955.

Periodic fluctuations in real GDP are called

a. business cycles b. recessions c. peaks d. expansions e. troughs

A risk-neutral person would be equally happy with $1 or a 50% chance of winning $2.

a. true b. false

Game theory would classify a cartel under the topic of

A) zero-sum games. B) cooperative games. C) noncooperative games. D) dominant-strategy games.