A radio manufacturer has two plants - one in Taiwan and one in California. At the current allocation of total output between the two plants, the last unit of output produced in the Taiwan plant added $8 to total cost, while the last unit of output produced in the California plant added $6 to total cost. In order to maximize profit, the firm should

A. produce all its output in the Taiwan plant.

B. produce all its output in the California plant.

C. keep the allocation between plants unchanged.

D. switch some output from the Taiwan to the California plant.

E. switch some output from the California to the Taiwan plant.

Answer: D

You might also like to view...

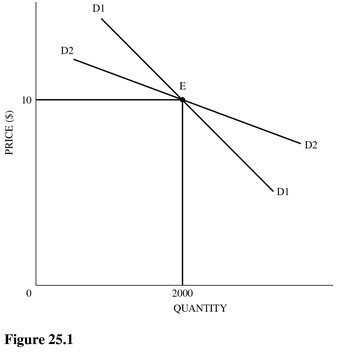

Refer to the figure above. If a price control is imposed at $8, what is the deadweight loss?

A) $10 B) $50 C) $65 D) $85

Since 1929, the distribution of income in the United States has become:

a. substantially more equal. b. slightly more equal. c. slightly more unequal. d. substantially more unequal.

In competitive markets, which of the following is not correct?

a. Firms produce identical products. b. No individual buyer can influence the market price. c. Some sellers can set prices. d. Buyers are price takers.

Refer to Figure 25.1 for an oligopoly firm. Assume that the existing price and quantity are $10 and 2,000 units. Which of the following statements is most likely correct?

Refer to Figure 25.1 for an oligopoly firm. Assume that the existing price and quantity are $10 and 2,000 units. Which of the following statements is most likely correct?

A. Demand curves D1 and D2 both assume that rivals will not match any price changes. B. Demand curve D1 assumes that rivals match any price changes. C. Demand curves D1 and D2 both assume that rivals match any price changes. D. Demand curve D2 assumes that rivals match any price changes.