Use the following advice from most financial advisors to solve the problem. ? Spend no more than 28% of your gross monthly income for your mortgage payment. ? Spend no more than 36% of your gross monthly income for your total monthly debt.Round all calculations to the nearest dollar, if necessary.Suppose that your gross annual income is $60,000.(a) What is the maximum amount you should spend each month on a mortgage payment?(b) What is the maximum amount you should spend each month for total credit obligations?(c) If your monthly mortgage payment is 75% of the maximum amount you can afford, what is the maximum amount you should spend each month for all other debt?

A. (a) $1400; (b) $1800; (c) $1050

B. (a) $16,800; (b) $21,600; (c) $9000

C. (a) $1400; (b) $1800; (c) $750

D. (a) $1400; (b) $1800; (c) $50

Answer: C

Mathematics

You might also like to view...

Multiply.-6(4m - 9)

A. 54m - 24 B. -54m + 24 C. -24m - 54 D. -24m + 54

Mathematics

Use the remainder theorem and synthetic division to find f(k).k = -3 + 2i; f(x) = x2 - 5x - 5

A. -7 B. 20 - 16i C. 15 - 22i D. 15 - 16i

Mathematics

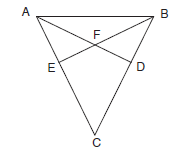

In isosceles ?ACB, AC ? BC, in isosceles ?AFB, AF?BF. Prove that AEBC ? ?DAC.

Mathematics

Solve the problem.Suppose that  is invested at an interest rate of

is invested at an interest rate of  per year, compounded continuously. What is the balance after 3 years?Round to the nearest cent.

per year, compounded continuously. What is the balance after 3 years?Round to the nearest cent.

A. $6348.00 B. $7044.00 C. $7140.33 D. $7240.33

Mathematics