The above figure shows the demand and supply curves in the market for milk. Currently, the market is in equilibrium

If the government imposes a $2 per gallon tax to be collected from sellers, calculate the dead weight loss associated with the tax, and explain why the dead weight loss occurs.

The deadweight loss equals .5 ? 2 ? 500 ? $500. The deadweight loss occurs because the tax lowers the output from the competitive level. At the output level that occurs with the tax, consumers value the last unit of output by more than it costs to produce that unit.

You might also like to view...

If a good is not produced, then there is no demand for it

Indicate whether the statement is true or false

A person who has taken medical leave is

A) in the labor force. B) not in the labor force. C) unemployed. D) a job leaver.

The economy's demand for loanable funds is not

a. the same as the economy's supply of capital b. downward sloping c. the sum of all individual firms' demands at every interest rate d. the sum of all the firms' marginal revenue product of capital curves e. a function of the rate of interest

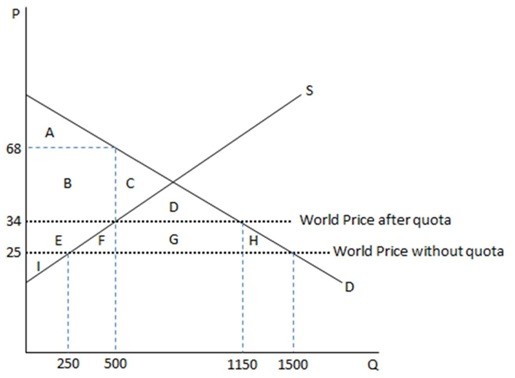

This graph demonstrates the domestic demand and supply for a good, as well as a quota and the world price for that good. According to the graph shown, when this economy is open to free trade without restriction, the amount imported is:

According to the graph shown, when this economy is open to free trade without restriction, the amount imported is:

A. 900. B. 1250. C. 1000. D. 650.