Why is the nominal interest rate the opportunity cost of holding money?

What will be an ideal response?

The nominal interest rate is the opportunity cost of holding money because the nominal interest is the income forgone by holding money. For instance, an individual with $1,000 can hold the funds either as money or as a financial asset with an interest rate of, say, 7 percent. If the funds are held as money, the interest paid is $0; if they are held as a financial asset, the interest paid is $70. Choosing to hold the funds as money therefore has an opportunity cost of the interest income forgone, which is $70 or 7 percent per dollar. So, the opportunity cost of each dollar held as money is 7 percent.

You might also like to view...

The figure above shows the market for airline tickets. In early 2008 firms negotiated lower wages with their workers. This change is shown in the figure as a shift from

A) D0 to D1. B) D1 to D0. C) S0 to S1. D) S1 to S0.

Rent seeking creates incentives for firms to use resources efficiently.

Answer the following statement true (T) or false (F)

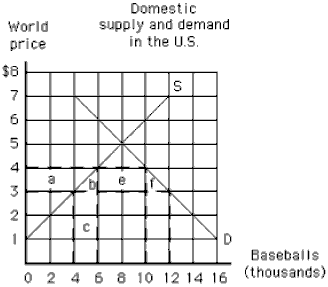

Figure 17-13

In , if the world price of a baseball is $3 and a tariff of $1 per baseball is imposed in the United States, how many baseballs will be purchased in the United States?

a.

4,000

b.

6,000

c.

8,000

d.

10,000

e.

12,000

What turns a business cycle into a structural stagnation?

A. Multiple business cycles in a short period of time. B. An upturn that exceeds potential. C. A trough that is lower than the peak. D. A slow upturn that keeps the economy below trend.