The alternative minimum tax (AMT) was created to

A. make sure that everyone had an equal chance of facing a tax audit.

B. make sure that upper income taxpayers could not use deductions to avoid paying income taxes.

C. make sure poor people paid at least something in taxes.

D. make sure that everyone paid the same proportion of their income in taxes.

Answer: B

You might also like to view...

Refer to the Article Summary. Labor productivity in the UK was well below the productivity in five of the other G7 nations, only faring better than Japan.. Labor productivity is important for an economy because an increase in labor productivity

A) allows the average consumer to increase consumption. B) will create short-run, but not long-run, economic growth. C) will increase output and decrease wages in the long run. D) will increase the labor force participation rate.

A country possesses a comparative advantage in the production of a product if

A) the opportunity cost, in terms of the amount of other products that it gives up to produce this product, is lower than it is for its trading partners. B) it possesses an absolute advantage in the production of this good compared to its trading partners. C) it is able to produce less of this good per worker than its trading partners. D) it can produce more of this good per hour than its trading partners.

What is his expected loss after installing the safety equipment

a. $20,000 b. $50,000 c. $100,000 d. $125,000

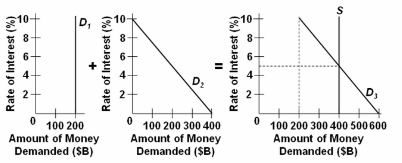

Suppose the demand for money and the supply of money increase simultaneously. We can:

A. expect the interest rate to rise and bond prices to fall.

B. expect the interest rate to fall and bond prices to rise.

C. the nominal GDP to expand.

D. not accurately predict what will happen to interest rates or bond prices.