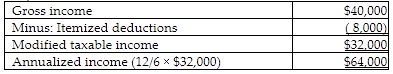

Emma, a single taxpayer, obtains permission to change from a calendar year to a fiscal year ending June 30, 2018. During the six months ending June 30, 2018, she earns $40,000 and has $8,000 of itemized deductions. What is the amount of her annualized income?

A) $32,000

B) $28,000

C) $64,000

D) $56,000

C) $64,000

You might also like to view...

The corporate officers are responsible for

A) arranging for major bank loans. B) determining corporate policy. C) carrying out corporate policy. D) appointing the board of directors.

Which of the following transactions would increase a firm's current ratio?

a. Purchase of inventory on account b. Payment of accounts payable c. Collection of accounts receivable d. Purchase of temporary investments for cash

Implied-in-fact conditions must fully and literally occur, and they are understood by the parties to be part of the agreement

a. True b. False Indicate whether the statement is true or false

A company factored $45,000 of its accounts receivable and was charged a 4% factoring fee. The journal entry to record this transaction would include a:

A. Debit to Cash of $43,200, a debit to Factoring Fee Expense of $1,800, and a credit to Accounts Receivable of $45,000. B. Debit to Cash of $46,800 and a credit to Accounts Receivable of $46,800. C. Debit to Cash of $45,000 and a credit to Notes Payable of $45,000. D. Debit to Cash of $45,000, a debit to Factoring Fee Expense of $1,800, and a credit to Accounts Receivable of $46,800. E. Debit to Cash of $45,000 and a credit to Accounts Receivable of $45,000.