List the seven fund financial statements that are required as part of the basic financial statements by GASB standards. What measurement focus and basis of accounting should be used in preparing each of these statements?

What will be an ideal response?

These seven fund statements are required in the basic financial statements (assuming that an entity has funds in each of the three fund types):

Balance sheet-governmental funds

Statement of revenue, expenditures, and changes in fund balances-governmental funds

Statement of net position-proprietary funds

Statement of revenues, expenses, and changes in fund net position-proprietary funds

Statement of cash flows-proprietary funds

Statement of fiduciary net position

Statement of changes in fiduciary net position

In addition, a reconciliation of (1) the total fund balance of governmental funds from the balance sheet-governmental funds to the governmental activities net position from the government-wide statement of net position, and (2) the change in total fund balances of governmental funds from the statement of revenue, expenditures, and changes in fund balances-governmental funds to the change in governmental activities net position from the government-wide statement of activities, are required on the face of the financial statements or as separate schedules.

The governmental funds are accounted for using the current financial resources measurement focus and modified accrual basis of accounting. The proprietary and fiduciary funds are accounted for using the economic resources measurement focus and accrual basis of accounting (except for certain liabilities of defined benefit pension plans and related postemployment healthcare plans).

You might also like to view...

Private companies and nonprofit organizations are also influenced by the Sarbanes-Oxley Act's accounting and corporate governance rules.

Answer the following statement true (T) or false (F)

Special requirements must be met to discharge toxic chemicals into surface waters

a. True b. False Indicate whether the statement is true or false

All of the following factors affect pricing strategies except

a. degree of competitive pressure. b. government mandates. c. changes in demand. d. distribution costs.

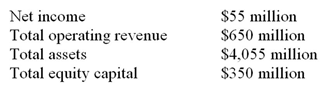

Following is the information listed below for Carter State Bank. What is the bank's ROA?

A. 8.46 percent

B. 16.03 percent

C. 15.71 percent

D. 1.36 percent

E. None of the options is correct