How much intercompany (after-tax) profit was realized during 2019 on Stempy's 2019 sale of assets to Rin?

Rin owns 90% of Stempy Inc. On January 1, 2018, the investment in Stempy account had a balance of $350,000 and Stempy's common shares and retained earnings on that date were valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a

remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy.

Rin sold depreciable assets to Stempy on January 1, 2018 at an after-tax gain of $10,000. On January 1, 2019, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years.

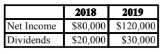

Stempy's Net Income and Dividends for 2018 and 2019 are shown below.

A) Nil. B) $1,000. C) $2,000. D) $10,000.

C) $2,000.

You might also like to view...

Depreciation is a noncash expense that is added back to net income in determining cash provided from operating activities under the indirect method

a. True b. False Indicate whether the statement is true or false

Typically a systems analysis

a. results in a formal project schedule b. does not include a review of the current system c. identifies user needs and specifies system requirements d. is performed by the internal auditor

Nipennie and Mirasa, two developing countries, bartered cotton for jute rather than for currency. In this scenario, the two countries engaged in _____.

A. foreign franchising B. fair trade C. arbitrage D. countertrade

Shortcomings of the dividend pricing models suggest that we need a pricing model that is more inclusive than the dividend models and provides expected returns for companies based on aspects besides their historical dividend patterns

Which of the below is NOT one of these aspects? A) The company's risk B) The premium for taking on risk C) The reward for waiting D) Stable dividends