Starting from long-run equilibrium, a large tax increase will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. recessionary; lower; potential

B. expansionary; lower; potential

C. expansionary; higher; potential

D. recessionary; lower; lower

Answer: A

You might also like to view...

When there is only a weak link between work effort and reward

a. individuals will undertake fewer projects that create income. b. taxing the rich and distributing the money to the poor becomes the best way to increase the size of the economic pie. c. corporations will profit more. d. individuals have a strong incentive to undertake projects that generate income.

Suppose a plaintiff hires a lawyer to represent her in a court case. The lawyer will receive a share of the settlement if the plaintiff wins. Under this contract,

A) production efficiency cannot be achieved.

B) the client bears all of the risk.

C) the lawyer bears all of the risk.

D) the risk is shared.

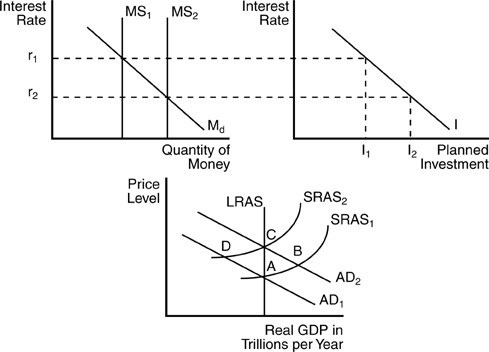

In the above figure, if the economy is initially at an equilibrium output at point A and the interest rate is r1, then an open market purchase of bonds by the Fed will

In the above figure, if the economy is initially at an equilibrium output at point A and the interest rate is r1, then an open market purchase of bonds by the Fed will

A. cause interest rates to increase and output to decline. B. cause interest rates to decline to r2, investment to increase to I2, and the AD curve to shift upward to the right. C. not have any impact on short- or long-run equilibrium real Gross Domestic Product (GDP). D. cause interest rates to decline to r2, investment to decline, and aggregate demand to shift inward to the left.

Input productivity refers to the amount of output produced per unit of the input.

Answer the following statement true (T) or false (F)