Consider the following:

(i) Define the term common property. Why does the use of common property create negative externalities? What do these externalities imply about the use of common property?

(ii) Define the term public good. Why does the production of a public good create positive externalities? What do these externalities imply about the private market's production of public goods?

(i) A common property is a nonexcludable, rivalrous resource that does not have a well-defined owner. Anyone who chooses to use the common property may do so. Each user of a common property, by adding to its congestion, reduces its value to others and thus creates an external cost. Unless these external costs are internalized, they will cause a common property to be overused.

(ii) A public good is one for which one person's production increases the amount available to everyone. Thus, when one person chooses to produce a public good, he creates external benefits for others. Private markets tend to underproduce public goods, because their social marginal benefit exceeds their private marginal benefit.

You might also like to view...

The advantages of maintaining monopolies:

A. always outweighs the total welfare costs due to lost surplus. B. sometimes outweighs the total welfare costs due to lost surplus. C. never outweighs the total welfare costs due to lost surplus. D. is a normative argument that has no right answer.

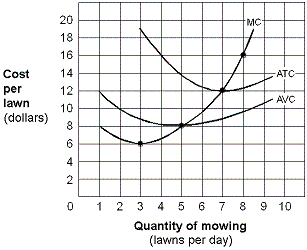

Exhibit 8-15 Short-run cost curves for E-Z Care lawn mowing company

A. $6 per lawn. B. $8 per lawn. C. $12 per lawn. D. $16 per lawn.

________ is available only to low-income families with children.

A. Medicare B. The SNAP program C. The Earned Income Tax Credit D. Medicaid

Through the start of 2009, Social Security revenues exceeded payouts, and the excess inflow was used to buy:

A. Public lands B. Gold certificates C. Foreign securities D. Treasury securities