During Year 2, Oklahoma Trucking Co. had service revenue on account of $350,000. Oklahoma had a beginning balance in Accounts Receivable of $35,000 and an ending balance of $42,500. During the year Oklahoma wrote-off $8,750 of receivables. Oklahoma uses the direct write-off method.a) Prepare the journal entry to record Oklahoma's revenue for Year 2.b) Prepare the journal entry to record the write-off of the receivables during Year 2.c) Determine the amount of cash that Oklahoma collected from customers during Year 1.

What will be an ideal response?

c) $333,750

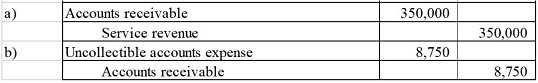

a) The revenue earned on account is recorded as a debit to accounts receivable and a credit to service revenue.

b) Using the direct write-off method, the write-off is recorded as a debit to uncollectible accounts expense and a credit to accounts receivable.

c) Ending accounts receivable of $42,500 = Beginning accounts receivable of $35,000 + Revenue on account of $350,000 ? Collections (the unknown) ? $8,750 write-offs

Collections = $35,000 + $350,000 ? $8,750 ? $42,500 = $333,750

You might also like to view...

Global standardization strategy emphasizes customization and product differentiation.

Answer the following statement true (T) or false (F)

The ______ is a quantitative technique used to determine the location of a single warehouse or distribution center in order to minimize its distribution costs.

a. breakeven analysis b. factor rating method c. center-of-gravity method d. GIS method

Emily checks her luggage at Flyaway Airlines's ticket counter before boarding her flight to Houston. Subject to a bailment is

A. Emily. B. Emily's luggage. C. Emily's ticketed seat on the flight. D. none of the choices.

The most productive CSRs focus solely on the typical customer concerns of billing, deliveries, or faulty merchandise, and are not concerned by other sensitive issues the customer may be experiencing.

Answer the following statement true (T) or false (F)