Raul has an adjusted income of $153,850, is married, and files jointly. Compute his tax.

Revised 2003 Tax Rate Schedules If TAXABLE INCOMEThe TAX is Is OverBut Not OverThis AmountPlusThis %Of theExcess OverSCHEDULE Y-1 -Married Filing Jointlyor Qualifying Widow(er)$0$14,000$0.0010%$0.00$14,000$56,800$1,400.0015%$14,000$56,800$114,650$7,820.0025%$56,800$114,650$174,700$22,282.5028%$114,650$174,700$311,950$39,096.5033%$174,700$311,950-$84,389.0035%$311,950

A. $32,082.50

B. $10,976.00

C. $33,258.50

D. $22,282.50

E. $22,377.50

Answer: C

Mathematics

You might also like to view...

Solve the problem.The area A = ?r2 of a circular oil spill changes with the radius. At what rate does the area change with respect to the radius when

A. 16? ft2/ft B. 64? ft2/ft C. 8? ft2/ft D. 16 ft2/ft

Mathematics

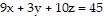

Solve the problem.Determine the point on the plane  that is closest to the point

that is closest to the point

A. (-2, -1, -3) B. (2, 1, -3) C. (2, -1, 3) D. (-2, 1, -3)

Mathematics

Is the following correspondence a function?Domain: All students attending the University of OhioCorrespondence: Each student's teachersRange: A set of teachers

A. Yes B. No

Mathematics

Find fx(x, y).f(x, y) = ln xy

A.

B.

C. y ln x

D.

Mathematics