Jeffreys Company reports depreciation expense of $57,000 for Year 2. Also, equipment costing $191,000 was sold for a $11,700 loss in Year 2. The following selected information is available for Jeffreys Company from its comparative balance sheet. Compute the cash received from the sale of the equipment.At December 31Year 2Year 1Equipment$695,000? $886,000? Accumulated Depreciation-Equipment 496,000? 585,000?

A. $33,300.

B. $77,300.

C. $56,700.

D. $57,000.

E. $45,000.

Answer: A

You might also like to view...

One procedure that is common to an audit engagement, as well as to both the compilation and review engagement, is obtaining an engagement letter

a. True b. False Indicate whether the statement is true or false

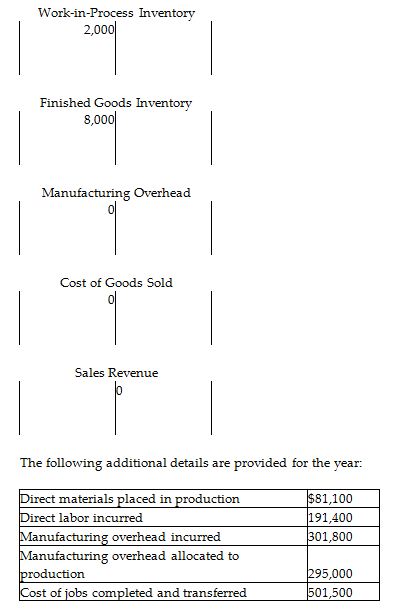

At the beginning of the year, Tea Tree Manufacturing had the following account balances:

The unadjusted balance in the Manufacturing Overhead account is a ________.

A) credit of $295,000

B) credit of $6800

C) debit of $6800

D) debit of $301,800

In ____________________, the neutral third party investigates the dispute and makes nonbinding recommendations for a settlement.

A. mediation B. a public probe C. fact-finding D. arbitration

To provide additional privacy, a ____ wall was installed in our office

A) stationery B) stationary