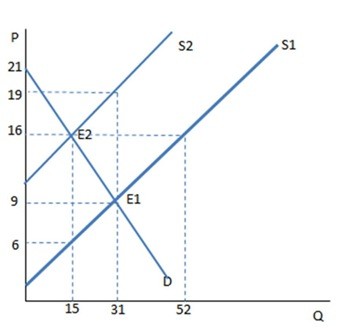

Suppose a tax has been imposed in the graph shown. Which kind of tax is most likely demonstrated by this graph?

Suppose a tax has been imposed in the graph shown. Which kind of tax is most likely demonstrated by this graph?

A. A tax on sellers

B. A tax on big corporations

C. A price ceiling

D. A tax on buyers

Answer: A

You might also like to view...

What is an import quota?

What will be an ideal response?

If all banks are subject to a uniform 20% reserve requirement and demand deposits are the only form of money, a $1,000 open market sale by the Fed would cause the money supply to

A. increase by $1,000. B. decrease by $1,000. C. decrease by $5,000. D. increase by $5,000.

Suppose a shipping company required all applicants to lift fifty-pound boxes on and off a truck for an hour to test their strength and endurance and suppose that resulted in 50-out-of-100 black applicants being hired and 10-out-of-100 white applicants being hired. If this test measured the performance required on the job then this would be an example of

A. disparate treatment discrimination. B. adverse impact discrimination. C. statistical discrimination. D. rational discrimination.

Should the government provide more and more public goods, so that we move increasingly towards a 'welfare state'? Why or why not?

What will be an ideal response?