Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee. Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that  is paid for any overtime in a

is paid for any overtime in a  week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxWilson, M. 37.5 $7.50

week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxWilson, M. 37.5 $7.50

A. $3.41, $0.80, $0.55

B. $26.16, $6.12, $4.22

C. $17.44, $4.08, $2.81

D. $20.25, $6.89, $5.63

Answer: C

Mathematics

You might also like to view...

List all the elements of B that belong to the given set.B = {8,  , -22, 0,

, -22, 0,  , -

, -  , 2.2, 16?, 0.168168168...}Integers

, 2.2, 16?, 0.168168168...}Integers

A. {8, -22}

B. {8, -22, 0}

C. {8, 0}

D. {8, 0,  }

}

Mathematics

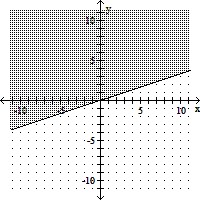

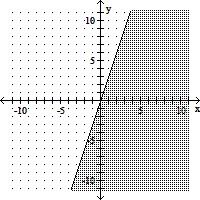

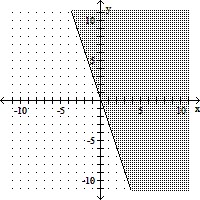

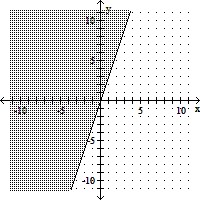

Graph the linear inequality.y ? 3x

A.

B.

C.

D.

Mathematics

Multiply. ?

?

A.

B. 10x

C. 21x

D.

Mathematics

Find the probability of the given event.A single fair die is rolled. The number on the die is a 3 or a 4.

A.

B.

C.

D. 2

Mathematics