In the short run if the tax rate on asset income rises, then in the market clearing model:

a. household current consumption will fall compared to future consumption.

b. the after tax real interest rate rises.

c. current investment will fall.

d. all of the above.

Answer: c. current investment will fall.

You might also like to view...

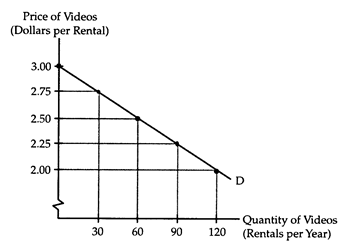

The diagram below shows Spencer's annual demand for videos. Spencer currently rents videos from Blockpopper's, which charges $2.50 per rental.

(i) How many videos does Spencer rent each year? How much consumer's surplus does Spencer receive from renting videos?

(ii) Blockpopper's starts a "frequent viewers" club. For a membership fee of $35 per year, club members can rent as many videos as they wish at the discounted price of $2 per rental. Should Spencer join the "frequent viewers" club? If yes, how much surplus value would Spencer receive as a club member? If no, what membership fee would Spencer be willing to pay to join the club?

The use of incentive payments for salespeople combats

A) both adverse selection and moral hazard. B) neither adverse selection nor moral hazard. C) adverse selection but not moral hazard. D) moral hazard but not adverse selection.

Refer to Figure 6-10. A unit-elastic supply curve is shown in

A) Panel A. B) Panel B. C) Panel C. D) Panel D.

Because people are more health conscious today than ever before, the demand for French fries has steadily fallen, causing the wage rate

a. and employment of workers in the French fries labor market to fall b. and employment of workers in the French fries labor market to rise c. to rise and employment of workers in the French fries labor market to rise d. to fall and employment of workers in the French fries labor market to rise e. to fall because both the labor demand and supply curves to shift to the right