The firm's before-tax cost of debt is ________.

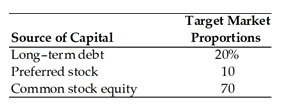

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

A) 7.8 percent

B) 10.6 percent

C) 11.2 percent

D) 12.7 percent

A) 7.8 percent

You might also like to view...

Which of the following is translating what is seen and heard into an understanding of the message?

A. noise B. decoder C. encoder D. sender

Explain the difference between passive and active listening. When is each type of listening appropriate?

What will be an ideal response?

The world economy is globalizing at an accelerated pace because

A. countries that previously had market or mixed economies now embrace planned economies. B. growth-minded companies are racing to build stronger competitive positions in the markets of more countries. C. countries opposed to market or mixed economies have erected more stringent trade barriers. D. countries previously open to foreign companies have closed their markets. E. information technology is exacerbating the importance of geographic distance.

When a release of hazardous chemicals from a site occurs, potentially responsible parties can avoid liability through transfer of ownership.

Answer the following statement true (T) or false (F)